Deduction Entries

"The user-friendly interface of TDS return software makes it easy for businesses to manage their tax compliance requirements, even for those without a background in accounting or finance."

"The cloud-based nature of Online TDS Software allows businesses to access their tax data from anywhere, anytime, providing flexibility and convenience."

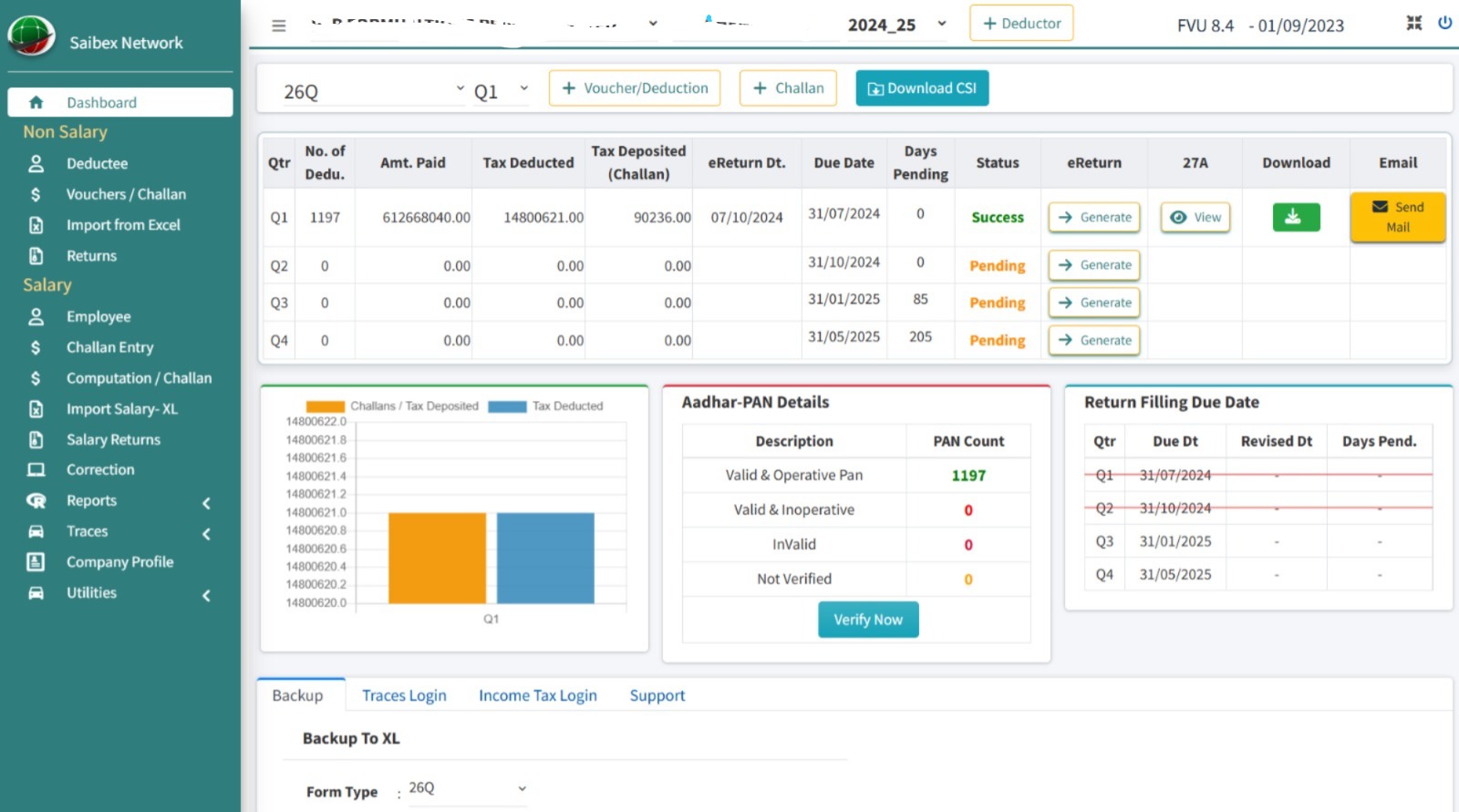

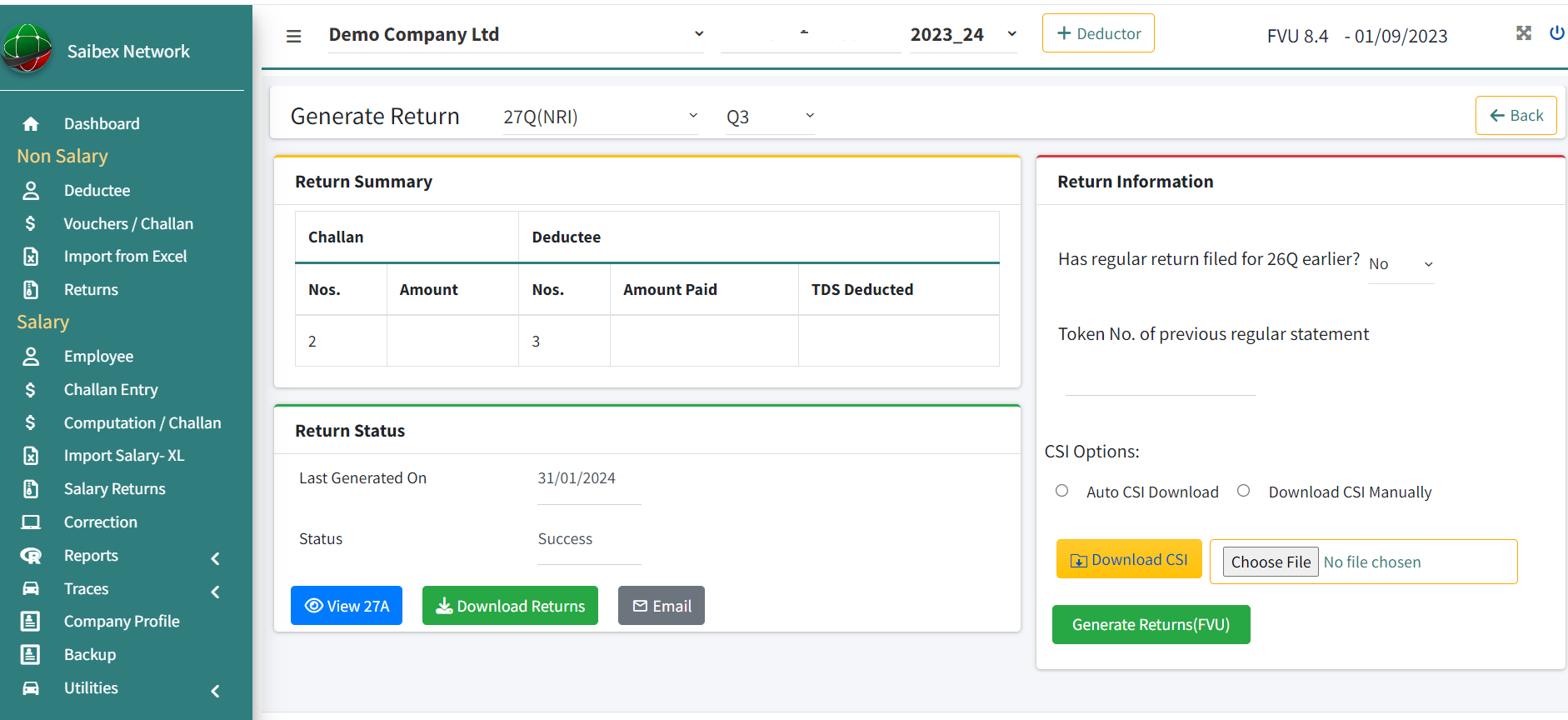

Online TDS is the complete TDS & TCS return preparation software exclusively designed as per the system specified by NSDL in line with the requirements of the Income Tax Department, Govt. of India. The software enables TDS & TCS return generation for all types of Forms - 24Q, 26Q, 27Q, 27EQ.

"It is easy to use, fast, reliable & hassle free software."

"The user-friendly interface of TDS return software makes it easy for businesses to manage their tax compliance requirements, even for those without a background in accounting or finance."

"TDS is No More Tedious Now"

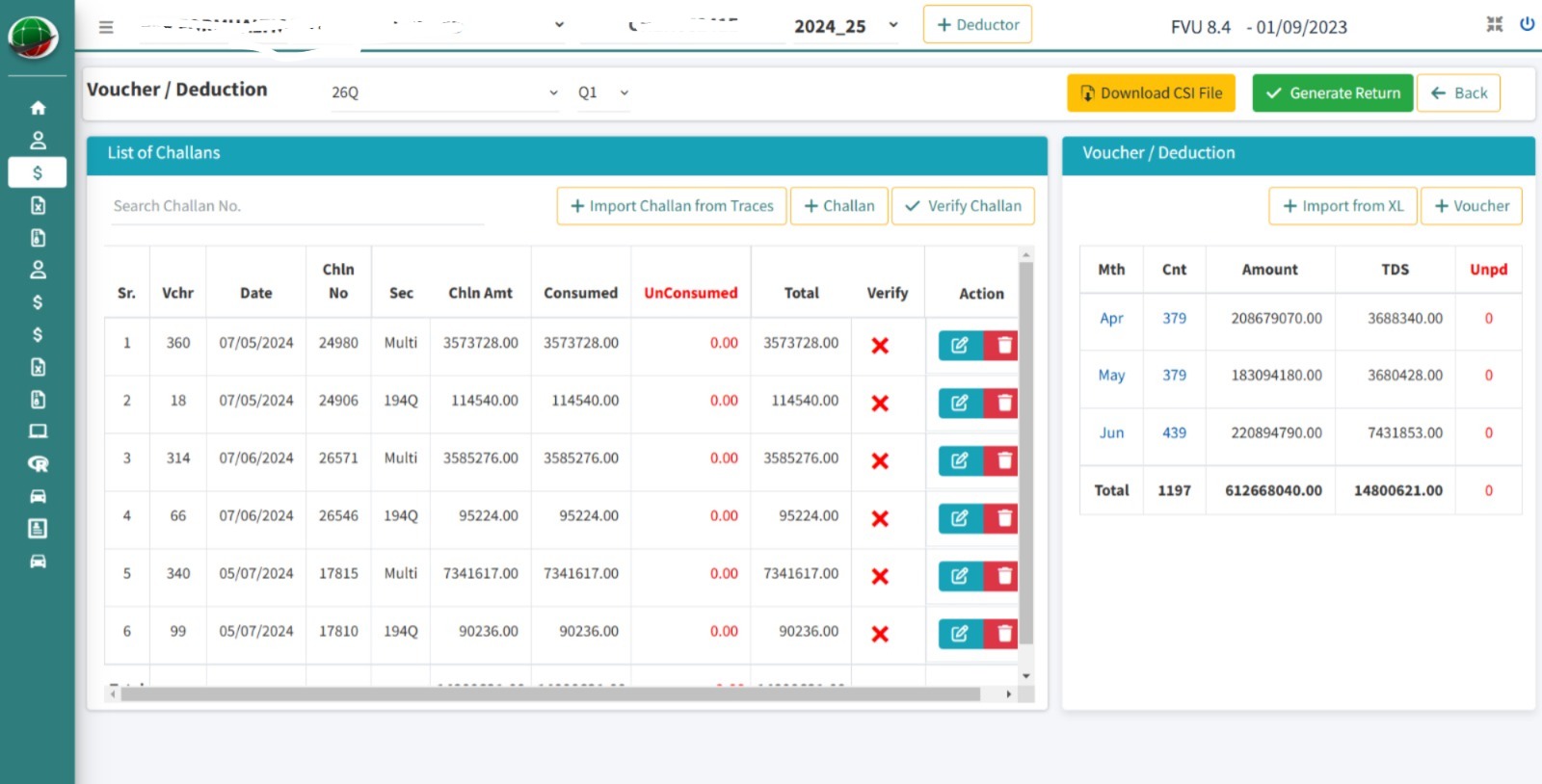

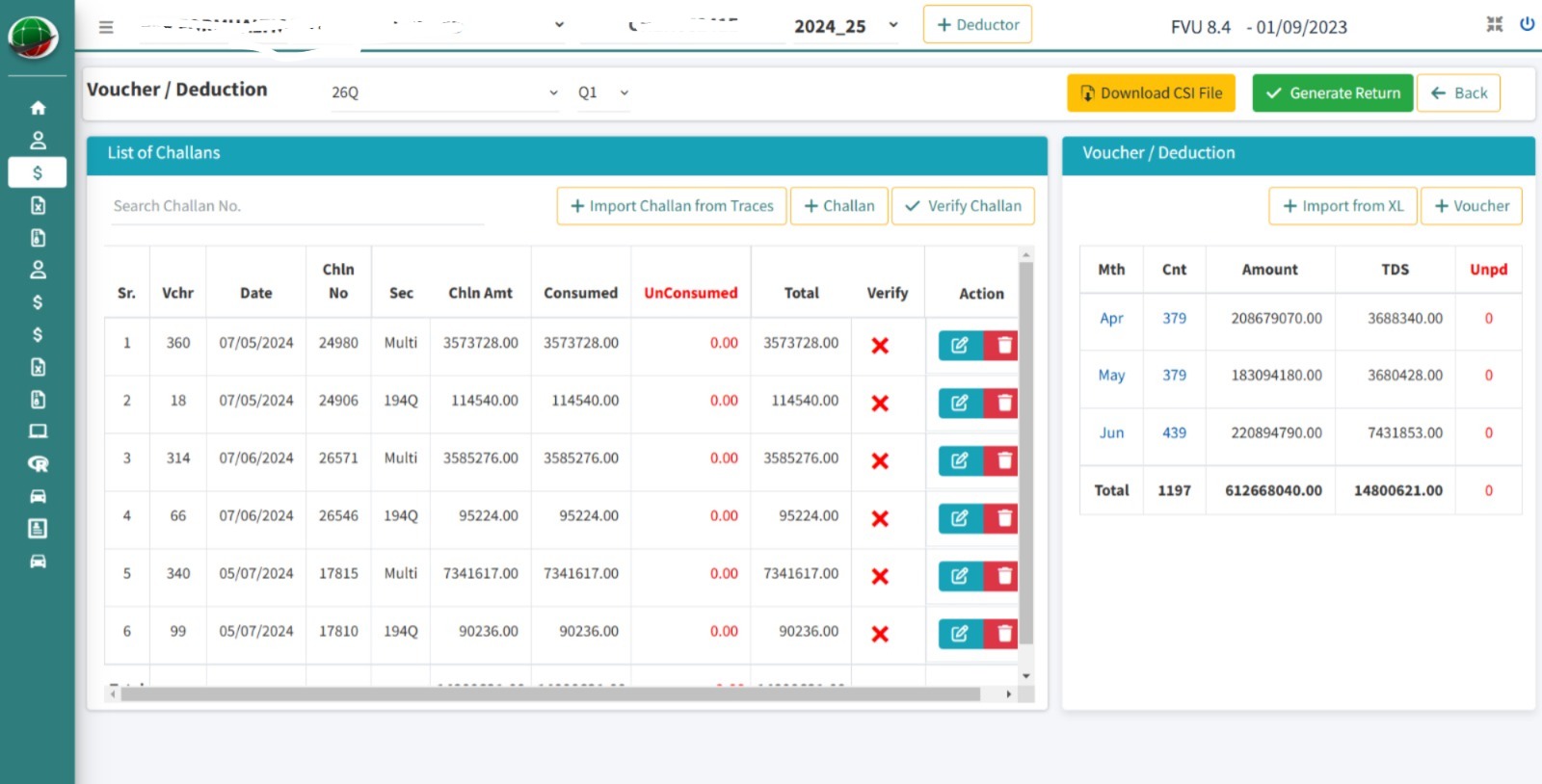

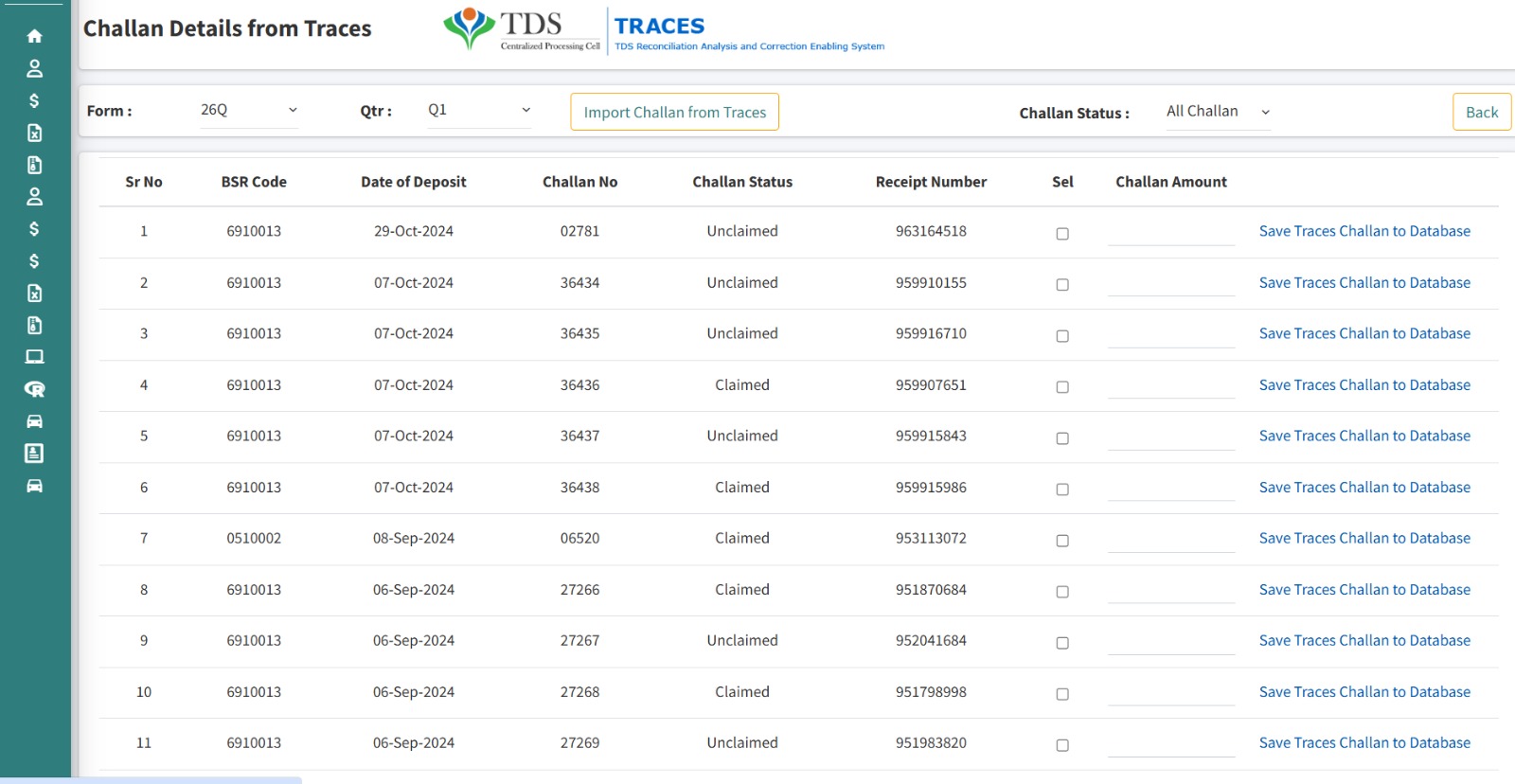

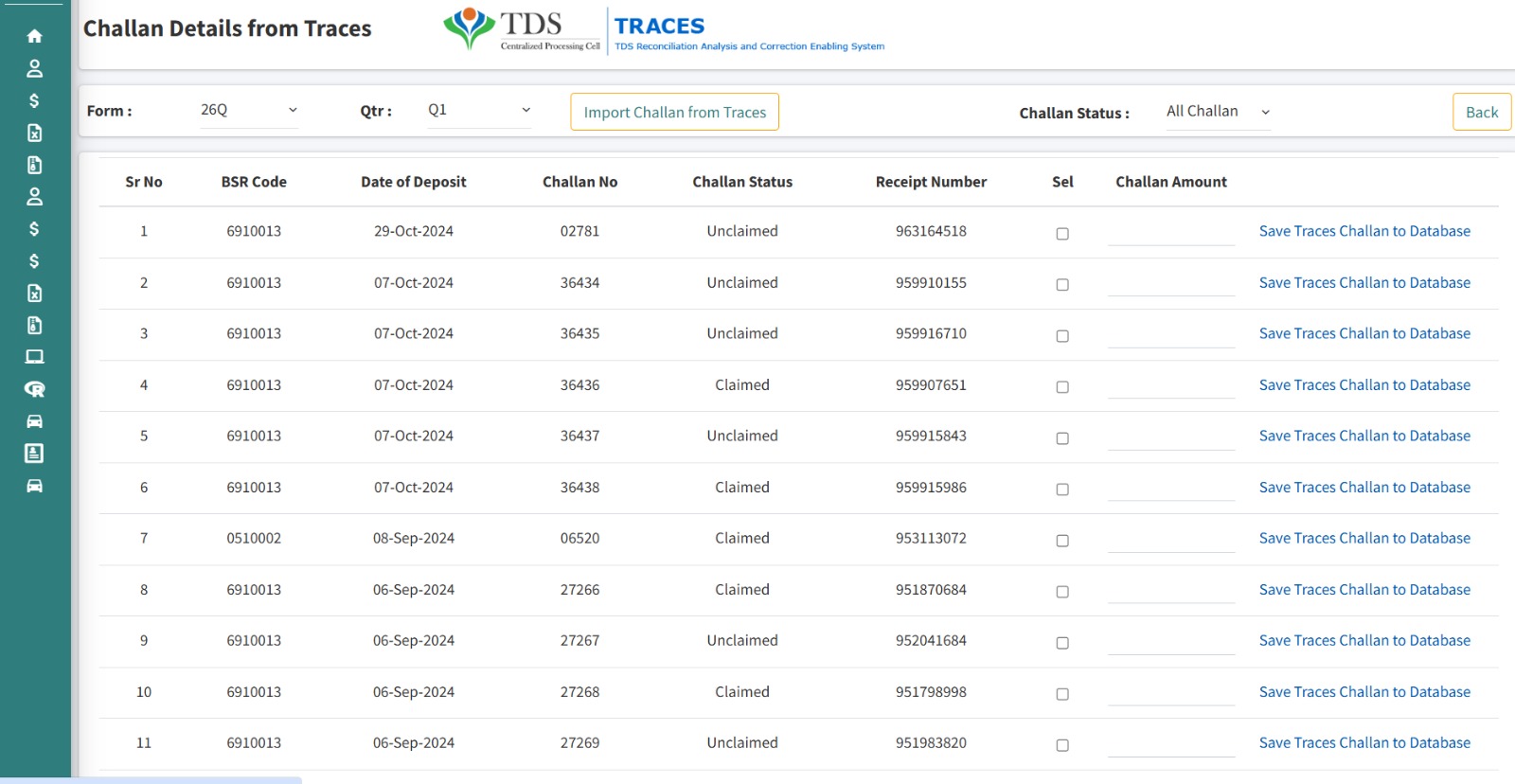

Online TDS Software, through its in-built utility, facilitates all its users to Import or Export required data or information from or to MS-Excel Files / Text File / FVU file. Customize your challans effortlessly, whether with deductions or without, providing flexibility tailored to your requirements.

Our TDS software now features Auto PAN Verification directly from TRACES, ensuring seamless and accurate validation of PAN details. This integration simplifies the process, enhances accuracy, and reduces errors, making tax management more efficient than ever

"Say goodbye to manual data entry – easily import your salary data into our software for faster processing and accuracy"

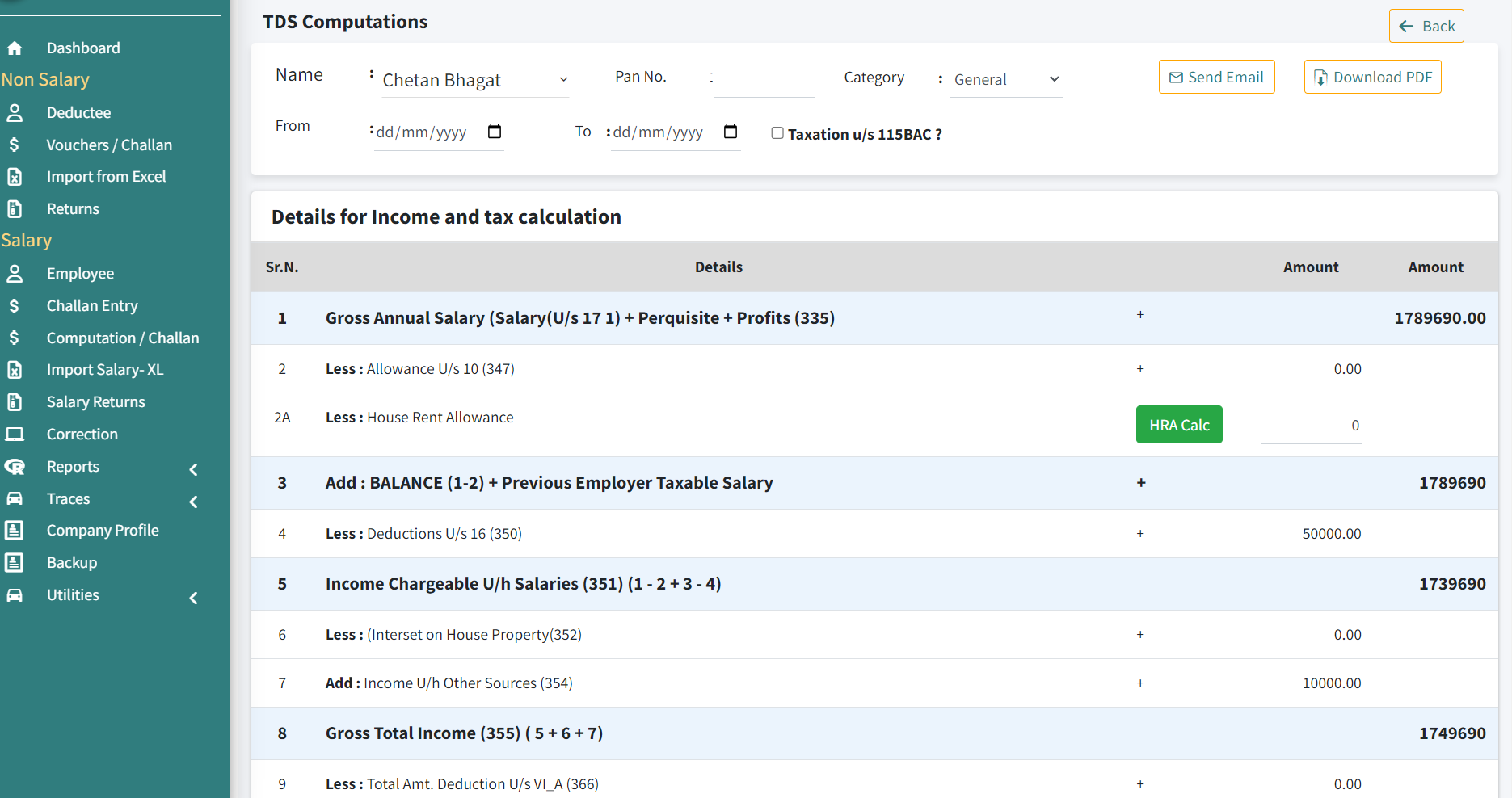

Using TDS software for salary computation can simplify the process of calculating taxes and deductions, reducing errors and ensuring compliance with tax laws and regulations.

Watch video tutorial Click here